In case you haven’t noticed, interest rates on savings accounts have risen dramatically over the past year. In fact, they are quite attractive! On top of that, certificates of deposit (CDs) are also posting favorable interest rates on your cash.

In case you haven’t noticed, interest rates on savings accounts have risen dramatically over the past year. In fact, they are quite attractive! On top of that, certificates of deposit (CDs) are also posting favorable interest rates on your cash.

If you aren’t familiar with CDs, these are a type of savings account that holds a fixed amount of money for a fixed period. They tend to offer higher interest rates than regular savings accounts because the agreement is that you lock your money for a term, generally ranging from three months to five years. If you withdraw your money before the end of the term, you may lose the interest you earned and/or be subject to a penalty.

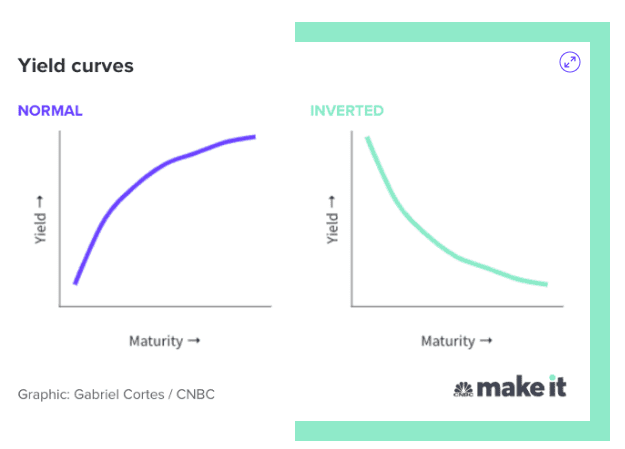

In general, what you will find is that the longer the term, the more generous the interest rate. That makes sense, right? The more time you agree to lock up your money, the more earnings you feel you should be entitled to. More risk; more reward.

However, what you see right now is that shorter-term CDs are more favorable than longer-term options. That seems counterintuitive, right? It’s because we are currently experiencing an “inverted yield curve.” But, before we get to the “why,” let’s talk about the “what.”

What is the yield curve anyway? A simple definition would be that the yield curve is a visual representation of how much it costs to borrow money for different periods of time. It is often used as a way to measure an investor’s feelings about risk and the direction of the economy.

Below is an example of a “normal” yield curve versus what is happening today.

So, why is this happening? Basically, investors have become nervous about the economy and have poured money into more “safe haven” long-term treasury bonds. Since prices on bonds and their yield (interest rate) move in opposite directions, demand in long-term bonds has caused the prices to surge while plunging their yields.

Some analysts see this rare event as a key economic signal, with many speculating that it foreshadows a potential recession. With short-term rates so high, companies can become reluctant to borrow capital for new equipment, facilities, and added employees.

How reliable a recession indicator an inverted yield curve presents is hard to predict for certain. Historically, it takes an average of 5 months for the economy to enter a recession once the yield curve inverts. This might mean we’re in a recession as you read this. Still, as the old adage says… past performance is no guarantee of future results. After all, the S&P 500 was up in 2023 – hardly a reflection of a pessimistic market!

The media likes to point to the inverted yield as a “doom & gloom” scenario. The reality is there are many other variables at work that help shape the US economy, and a recession is a natural, unavoidable stage in the economic cycle. Overall, even though headline news hardly paints a pretty picture of the economy as a whole, it is important to consider your long-term financial goals.

As financial planners, although we understand it helps people to understand why things happen, the best possible response is for people to focus their energy on the things they can control in their financial situation. We help clients gain that clarity every day, so if that is something you’re interested in, click here for more information.

Brett Lathrup is a CFP® professional and Certified College Financial Consultant (CCFC). When he is not helping clients, you can find Brett spending time in the great outdoors, being a pit boss on one of his many charcoal grills or smokers, or learning how to craft the perfect wood-fired pizza. Read more about Brett here.