When it comes to financial planning, many people often focus solely on the end result – the plan itself. But let me tell you, the real magic lies in the journey – the planning process.

When it comes to financial planning, many people often focus solely on the end result – the plan itself. But let me tell you, the real magic lies in the journey – the planning process.

Embrace the Learning Process

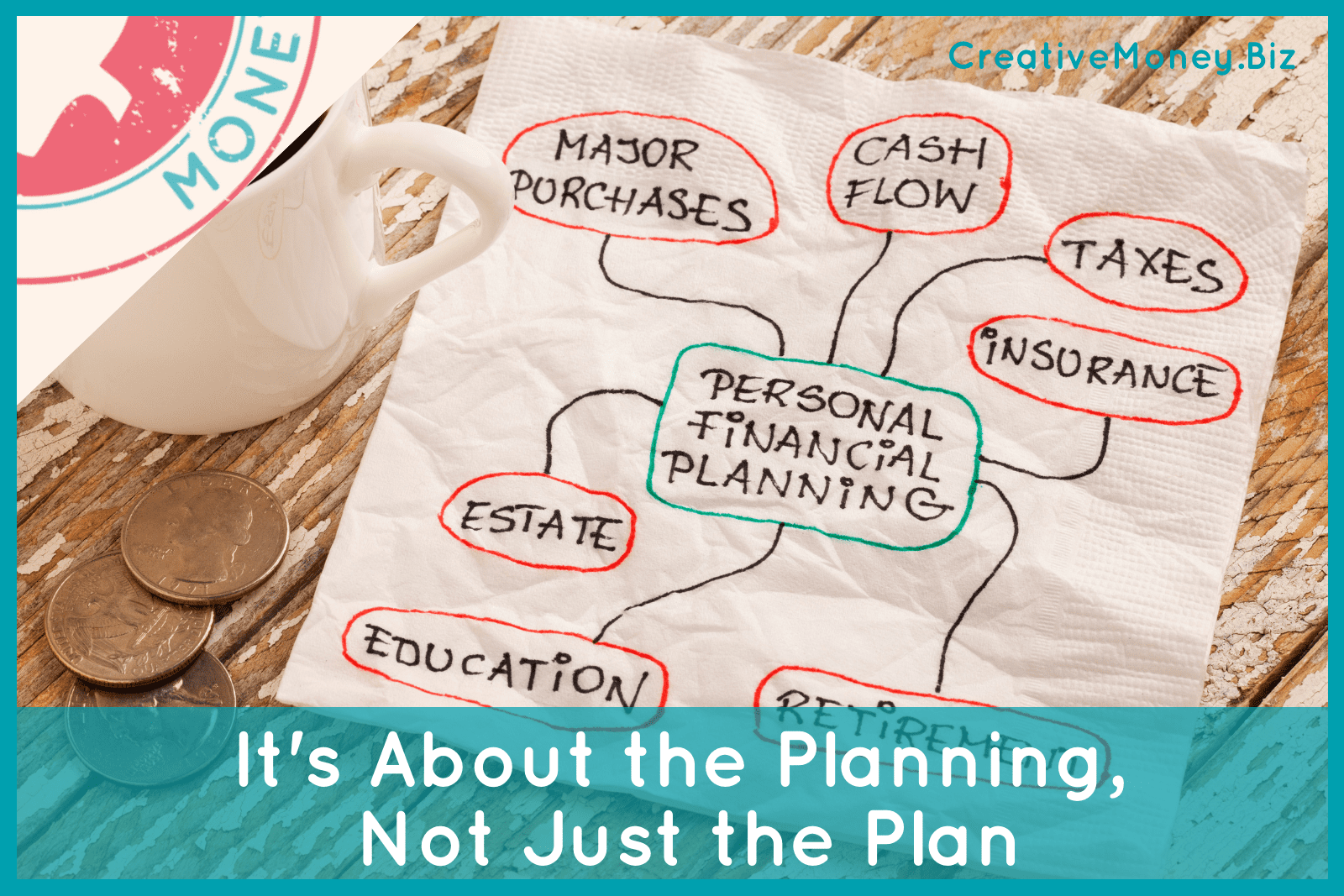

Taking control of your finances can be a daunting task, and it’s natural to feel anxious about making mistakes. To better understand your financial situation, it’s a great idea to start with a comprehensive financial plan.

But why stop there? Partnering with a financial planner who is committed to working through the planning process with you and explaining the knowledge and reasoning behind the plan can empower you to make more informed decisions in the future. This will allow you to become more proactive and confident in handling your finances, able to ask the right questions, find relevant information, and make sound financial decisions more easily.

The Plan is Your Roadmap, but Life is a Rollercoaster

A financial plan is often seen as a static document, neatly arranged with numbers and charts. But let’s face it, life is anything but static. It’s an unpredictable rollercoaster ride with unexpected twists and turns that no spreadsheet can fully capture (trust me, I’ve tried!).

Remember, the plan itself is just a starting point, a roadmap. Real-life financial planning gives you the power to adjust your course, revise your strategies, and make informed decisions based on your current circumstances. It provides you with the flexibility to adapt your plan as needed, ensuring that it remains relevant and effective.

Set Goals, Stay Motivated

A well-crafted financial plan sets you on the path to achieving your goals, whether buying a home, traveling the world, or retiring comfortably. But here’s the exciting part: the process of setting and refining your goals can be equally, if not more, motivating.

The planning process helps you align your financial decisions with what truly matters to you, ensuring that your money is being used in a way that reflects your values and aspirations. And every time you revisit your financial plan, you’re essentially reigniting your aspirations. Think of it as planting seeds of ambition that grow into your very own financial success story.

The Power of Planning

So, yes, having a financial plan is crucial, but remember that the plan is just a tool. The real power lies in the ongoing process—the learning, the adapting, and the journey itself.

As you embark on your financial planning adventure, don’t be afraid to revisit, revise, and reimagine your plan. Embrace the idea that the plan you start with may not be the same plan you end with, and that’s perfectly okay. Ultimately, it’s the planning, not just the plan, that paves the way to financial success.

Joann Nieciecki brings more than 20 years of experience in valuation consulting and advisory services to the Creative Money team. When she’s not busy having fun in Excel, Joann can be found spending time with her husband and two sons, watching Masterpiece mysteries, or <MASSIVE NERD ALERT> attempting to complete all the shrines in Zelda: BOTW. More about Joann here…